Daily Archives: May 21, 2024

Utilizing MetaTrader 4’s Pattern Recognition Capabilities

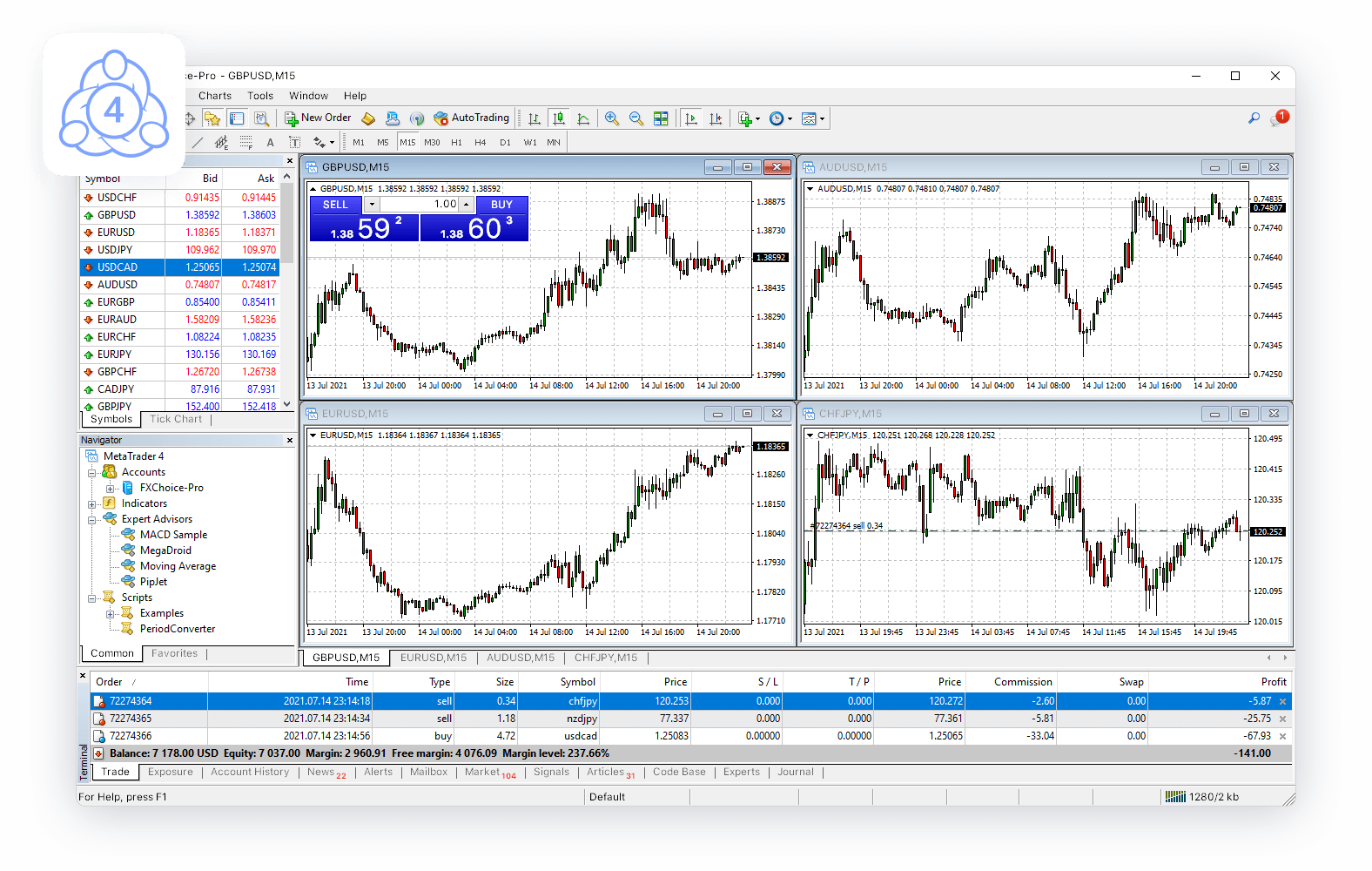

MetaTrader 4 (MT4) remains one of the most popular trading platforms among forex traders, and for good reason. Its user-friendly interface, extensive analytical tools, and customizable features make it an essential tool for both novice and experienced traders. One of the standout features of metatrader 4 for windows is its pattern recognition capabilities, which can significantly enhance trading strategies by identifying potential market trends and entry/exit points.

What is Pattern Recognition in Trading?

Pattern recognition in trading refers to the ability to identify specific patterns in price charts that suggest market movements. These patterns can indicate bullish or bearish trends and help traders make informed decisions. Common patterns include head and shoulders, triangles, flags, and pennants, each providing insights into potential market behavior.

How MetaTrader 4 Facilitates Pattern Recognition

Custom Indicators

One of MT4’s strengths is its ability to support custom indicators. Traders can download or create indicators that automatically identify and highlight specific patterns on their charts. This eliminates the need for manual scrutiny and increases efficiency.

Built-in Charting Tools

MT4 comes equipped with a wide array of charting tools that traders can use to draw trend lines, channels, and other graphical objects. These tools make it easier to spot patterns as they form, providing real-time insights into market movements.

Expert Advisors

MT4’s Expert Advisors (EAs) are automated trading systems that can be programmed to recognize patterns and execute trades based on predefined criteria. EAs can be incredibly useful for traders who rely on technical analysis and want to take advantage of pattern recognition without constantly monitoring their screens.

Practical Tips for Utilizing MT4’s Pattern Recognition

1. Customize Your Indicators: Take advantage of MT4’s vast library of custom indicators. Experiment with different ones to find those that best suit your trading style and strategy.

2. Backtest Your Strategies: Use MT4’s strategy tester to backtest your pattern recognition strategies. This allows you to see how your approach would have performed in historical market conditions, helping you refine your methods.

3. Stay Updated: The forex market is dynamic, and new patterns can emerge. Regularly update your indicators and EAs to ensure they remain effective in current market conditions.

4. Combine with Other Analyses: While pattern recognition is powerful, it’s always best to combine it with other forms of analysis, such as fundamental analysis and sentiment analysis, to make well-rounded trading decisions.

Conclusion

MetaTrader 4’s pattern recognition capabilities offer traders a robust toolset for identifying market trends and making informed trading decisions. By leveraging custom indicators, built-in charting tools, and Expert Advisors, traders can enhance their strategies and increase their chances of success in the forex market. As with any trading strategy, continuous learning and adaptation are key to staying ahead in the ever-evolving financial markets.

Insider Secrets of Successful CFD Trading

Contracts for Difference (CFDs) have gained popularity as versatile financial instruments, offering traders the opportunity to speculate on the price movements of various assets without owning the underlying asset itself. Here’s everything you need to know about CFD how it works.

1. What are CFDs?

CFDs are derivative products that allow traders to speculate on the price movements of financial assets such as stocks, commodities, indices, and currencies. With CFDs, traders can profit from both rising and falling markets.

2. How do CFDs work?

When trading CFDs, investors enter into a contract with a broker to exchange the difference in the price of an asset from the time the contract is opened to when it is closed. This enables traders to profit from price fluctuations without owning the actual asset.

3. Key Features of CFD Trading

Leverage: CFD trading offers flexible leverage, allowing traders to amplify their exposure to the market with a smaller initial investment. However, it’s important to use leverage cautiously as it can magnify both gains and losses.

Long and Short Positions: Traders can take long positions if they believe the price of an asset will rise, or short positions if they anticipate a price decline.

Diverse Asset Classes: CFDs provide access to a wide range of asset classes including stocks, commodities, indices, and currencies, allowing traders to diversify their portfolios.

4. Benefits of CFD Trading

Flexibility: CFDs offer flexibility in terms of trading strategies, allowing traders to implement various techniques such as hedging and speculation.

Liquidity: CFD markets are highly liquid, providing traders with the ability to enter and exit positions easily, even in large sizes.

No Ownership Requirement: Unlike traditional investing where ownership of the underlying asset is required, CFD trading does not involve ownership, making it simpler and more cost-effective.

5. Risks of CFD Trading

Leverage Risk: While flexible leverage can amplify profits, it also increases the potential for significant losses. Traders should be aware of the risks associated with leverage and use it responsibly.

Market Volatility: CFD prices are influenced by market volatility, which can lead to rapid price movements and increased risk.

Counterparty Risk: Since CFD trading involves a contractual agreement with a broker, there is a risk of default by the broker. It’s important to choose a reputable and regulated broker to mitigate this risk.

In conclusion, CFDs are powerful financial instruments that offer traders the opportunity to profit from the price movements of various assets. However, it’s essential to understand the risks involved and trade responsibly.