Tag Archives: calculator

What Is Monthly Budget Calculator?

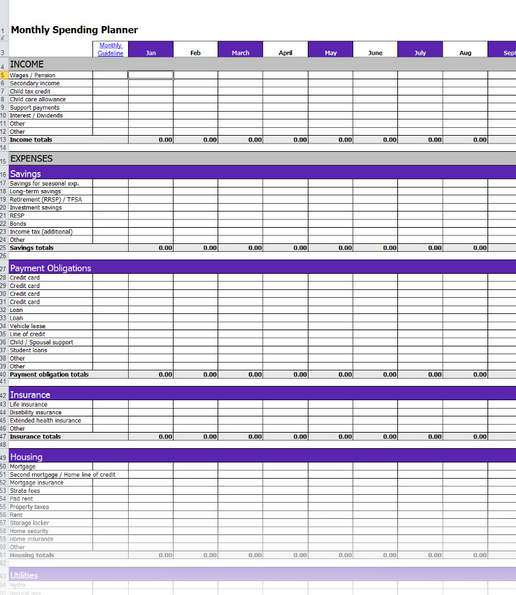

monthly budget calculator can be just a practice of arranging your month-to-month budget depending on your monthly income from many sources and money spent to hold all expenses for example maintainancecharge of residence, when you’ve got kids than their academic charges also includes. A thriving budget program is not going to result in any monetary catastrophe within the family.The elements necessary to figure the month-to-month budget are wages and got income, other income including alimony children support, talent, taxation yield andinvestments and savings.

Exactly why is It Essential to Figure that the Monthly budget?

Budgeting Is among the most powerful Financial tool. There are many reasons regarding why is it necessary to maintain a month-to-month budget.

• It Is Helpful to avoid financial catastrophe – Maintaining a monthly budget might be demonstrated to be very useful as it avert any fiscal breakdown at an long term. Financial breakdown means lack of money throughout certain irregular cases such as some health issue arises within the family, then there is a requirement of some budget.

• It helps to Commit money when the Market cost is high- The savings that we do are important because it can additionally help to make more dollars from the antecedent volume. This present amount or savings may additionally take out bills as soon as the small business will have no profit.

The best way to execute monthly budget calculator?

There Are Lots of ways to calculate the Total month-to-month budget. It’s possible to estimate your monthly funding manually and by using numerous tools available online to figure out the budget.For commanding the month-to-month expenditure we can cut out the extra expenses you simply do. For calculating the monthly payment we need to figure out the overall income of the household. Then your main thing we all must give attention to will be to save. When we separate an amount, together with the left out amount we can carry out our day-to-day wants. When per month that there are not much expenditure then we could save more in this month. Accordingly we are able to shell out to our day-to-day requirements.

Conclusion

Monthly budget calculator is highly Crucial to get Not just households but also in employers, industries. This helps to cope up with adverse Condition. It’s essential for us to aware of the plan to keep a sleek budget throughout the life.

Know About Mortgage Payoff Calculator

Dealing with home loans the simpler way is on everyone’s imagination. One way of ensuringmortgages are paid by altering repayments is through a mortgage payoff calculator. Employing this sort of economic calculator, one can alleviate out from mortgages because they are informed regarding how additional payments benefit one’s rates and time financial savings. This specific calculator performs on multiple variables in deciding how payments might be mortgage payoff calculator tweaked.

Information and facts to become assessed

You can find a number of variables after which one’s facts are determined from the mortgage payoff calculator, and they are generally as follows:

•Primary loan amount

•Bank loan length

•The interest of your mortgage loan

•Date in the preliminary extra repayment

•Added payments

Additional payments for one’s home loan are again sorted into – Once pay, Monthly pay out, Every quarter, and Yearly pay. With getting into these parameters, the calculator displays one’s recent transaction scheme together with the impact created by any additional transaction.

The thought behind extra repayments

When one particular decides to just pay one particular added transaction annually, this has been documented that you can preserve up a lot on rates of interest as well as pay back personal loans a lot before. The calculator is capable of doing supplying a precise thought of how to change obligations on the life-time of one’s loan.

It is very important remember that it is best to clear all pending financial obligations just before heading steadfast into added mortgage repayments. There is certainly much more financial safety when one holders clear coming from all pending dues and can solely pay attention to a wiser settlement system.

In conclusion

The mortgage calculator is urged by everybody to try for either their regular monthly more monthly payments or annual. This way, anybody can learn about financial savings with rates of interest and that additional repayment is made to the primary volume instead of fascination amount. You can also demystify the concept behind extra obligations by obtaining in touch with loan companies and learning what works for them.

Ref: https://arrestyourdebt.com/mortgage-payoff-calculator/