Tag Archives: metatrader 4

How Market Analysis Improves Online Trading Performance

In the fast-paced world of online trading, success is rarely a product of luck. Traders who consistently achieve profitable results understand the critical role of market analysis. By systematically examining market trends, price movements, and economic indicators, market analysis provides traders with actionable insights that enhance decision-making and improve overall trading performance.

Market analysis primarily involves two approaches: fundamental analysis and technical analysis. Fundamental analysis focuses on evaluating the economic, financial, and political factors that influence the value of assets. For instance, traders assess economic reports, interest rate changes, and corporate earnings to anticipate market movements. This type of analysis is especially valuable for long-term trading strategies, as it helps identify the intrinsic value of assets and potential market trends. By understanding the broader economic environment, traders can make informed decisions and reduce the likelihood of impulsive trades based on short-term volatility.

On the other hand, technical analysis concentrates on studying historical price data, trading volumes, and chart patterns to forecast future price behavior. Traders use tools such as moving averages, trend lines, and support and resistance levels to identify trading opportunities. Technical analysis enables precise entry and exit points, helping traders optimize their risk-reward ratio. When combined with fundamental insights, technical analysis allows traders to create a well-rounded strategy that balances long-term perspective with short-term execution.

One of the most significant benefits of market analysis is risk management. Understanding market dynamics allows traders to identify potential risks and adjust their positions accordingly. For example, recognizing overbought or oversold conditions can prevent losses during volatile periods. Market analysis also encourages discipline, ensuring that trades are based on data rather than emotions. This systematic approach helps traders stay consistent, even in unpredictable market conditions.

Additionally, continuous market analysis promotes adaptability. Markets are influenced by numerous factors, including geopolitical events, technological developments, and shifts in investor sentiment. Traders who monitor these changes and adjust their strategies accordingly are better equipped to capitalize on emerging opportunities while minimizing exposure to risk.

In conclusion, market analysis is an indispensable tool for enhancing online trading performance. By integrating fundamental and technical insights, traders gain a deeper understanding of market behavior, make informed decisions, and manage risk effectively. For anyone aiming to succeed in online trading, developing strong analytical skills and maintaining a disciplined approach can make the difference between short-term gains and long-term profitability.

How to Choose the Right Broker for Online Trading

Selecting the right broker is a fundamental step for anyone venturing into online trading. The broker acts as an intermediary between the trader and the financial markets, making their reliability, services, and conditions crucial to a trader’s success. With numerous options available, it is essential to evaluate brokers carefully to ensure a secure, efficient, and supportive trading experience.

Regulation and Trustworthiness

The foremost consideration when choosing a broker is regulatory compliance. Regulated brokers operate under strict guidelines set by financial authorities, providing a layer of security and accountability. Trading with a regulated broker reduces the risk of fraud and ensures that the broker adheres to standards that protect client funds and data. Verifying the broker’s licensing status and the jurisdiction they operate under is a critical initial step.

Trading Platforms and Tools

A broker’s trading platform is the gateway to the markets. It should be reliable, user-friendly, and equipped with essential analytical tools. Many brokers offer popular platforms with advanced charting features, customizable indicators, and automated trading capabilities. Access to a seamless and efficient platform enhances the trading experience, enabling timely decision-making and execution. Additionally, brokers that provide mobile trading apps give traders the flexibility to manage their positions on the go.

Range of Tradable Assets

Depending on individual trading goals, the availability of a broad range of assets may be important. Some brokers specialize in forex, while others offer access to stocks, commodities, indices, and cryptocurrencies. Choosing a broker that provides diverse markets can help traders diversify their portfolios and explore different trading opportunities.

Costs and Fees

Trading costs directly affect profitability, making fee structures a significant consideration. Brokers typically charge spreads, commissions, or a combination of both. Understanding these costs, along with any hidden fees such as withdrawal charges or inactivity penalties, is essential. Traders should seek brokers offering competitive fees without compromising service quality.

Customer Support and Education

Efficient customer service is invaluable, especially for new traders. Brokers that offer prompt, knowledgeable support through various channels enhance user confidence and resolve issues quickly. Furthermore, brokers that provide educational resources such as webinars, tutorials, and market analysis help traders develop their skills and stay informed.

Conclusion

Choosing the right broker requires a comprehensive evaluation of regulation, platform quality, asset availability, costs, and customer support. Taking the time to research and compare brokers ensures a safer and more effective trading experience. Ultimately, the ideal broker aligns with a trader’s specific needs and preferences, supporting their journey toward achieving consistent trading success.

Step-by-Step Guide to Installing MT4 on Android

MetaTrader 4 (MT4) has long been a favorite platform for forex and CFD traders, offering powerful tools for market analysis and trading. If you’re looking to manage your trades on the go, installing mt4 for android device is quick and easy. This guide will walk you through the step-by-step process so you can start trading anytime, anywhere.

Why Use MT4 on Android?

With the MT4 Android app, you can:

• Monitor markets on the go with live price updates.

• Execute trades in real time, ensuring you never miss an opportunity.

• Leverage advanced charting tools to analyze trends and make informed decisions.

Having MT4 on your smartphone means the power of professional trading is always in your pocket.

Step 1: Download the MT4 App

To get started, head over to the Google Play Store on your Android device. Search for “MetaTrader 4” in the search bar. Ensure you’re downloading the official app developed by MetaQuotes Software Corporation, as this ensures a safe and secure experience. Once found, tap “Install” and wait for the app to download.

Step 2: Open the App and Log in

Once the app is installed, open it. On the welcome screen, you’ll see two options:

• Log in to an Existing Account

• Open a Demo Account

If you already have a trading account, select the first option. Enter your broker’s server name, your account credentials, and login information. If you’re new to trading, you can create a free demo account to explore the features without the financial risk.

Step 3: Customize Your Interface

After logging in, you’ll be taken to the Quotes section, where you can view real-time market prices. To tailor the experience:

• Tap on a symbol to view options like charts and trade execution.

• Use the Settings menu to adjust language preferences, notifications, and chart settings.

Step 4: Start Trading

Navigate to the Trade tab to begin placing trades. Access detailed charts by selecting any currency pair or asset. Use the built-in technical indicators to refine your strategy.

++++++++++++++++++++++++++++++++++++++++++++++++++++++

Trading On-the-Go: Benefits of MT4 for Android

The world of trading doesn’t stop. Markets change in real-time, and opportunities wait for no one. For traders who want to stay ahead, mobility is key. Enter mt4 for android—a game-changing solution that lets you trade anytime, anywhere. Whether you’re on your morning commute or taking a break, this platform ensures you never miss a beat in the fast-paced trading environment.

Why Mobile Trading Matters

Mobile trading has completely transformed the way traders interact with the market. According to recent statistics, over 55% of global web traffic comes from mobile devices, and trading is no exception. The ability to monitor and execute trades from your smartphone offers unparalleled convenience and flexibility. It’s a competitive edge that no modern trader can afford to ignore.

MT4 for Android stands out in this crowded space for its efficiency and feature-rich design. Here’s why experienced traders and beginners alike are flocking to this platform.

Key Features of MT4 for Android

1. User-Friendly Interface

MT4 for Android is designed with simplicity in mind. The clean interface ensures both experts and novices can easily manage trades without a steep learning curve. Need to find a specific tool or chart? The intuitive layout has you covered.

2. Advanced Charting Tools

Chart analysis is critical for making informed trading decisions. MT4’s mobile app equips traders with interactive charts that feature multiple timeframes, custom indicators, and technical analysis tools—all from the palm of your hand.

3. Real-Time Data Access

Stay updated with live quotes and market conditions. MT4 for Android provides real-time data, ensuring you’re always in the loop, regardless of time or place.

4. Secure and Seamless Execution

Security is non-negotiable in financial trading, and MT4 ensures that your transactions remain safe. The app allows for one-tap trade execution, reducing lag and enabling quick decisions without compromising safety.

5. Customizable Alerts and Notifications

Set up alerts for price changes, news updates, or executed trades. This feature ensures that you’re always a step ahead, even when you’re not actively monitoring the app.

The “On-the-Go” Advantage

Today’s trading landscape rewards speed and flexibility. MT4 for Android offers the opportunity to execute trades while multitasking—allowing users to respond instantly to changing market trends without being tied to a desk. Who wouldn’t want the ability to manage their portfolio from anywhere in the world?

Maximizing Profits with MetaTrader 4 Trading Signals

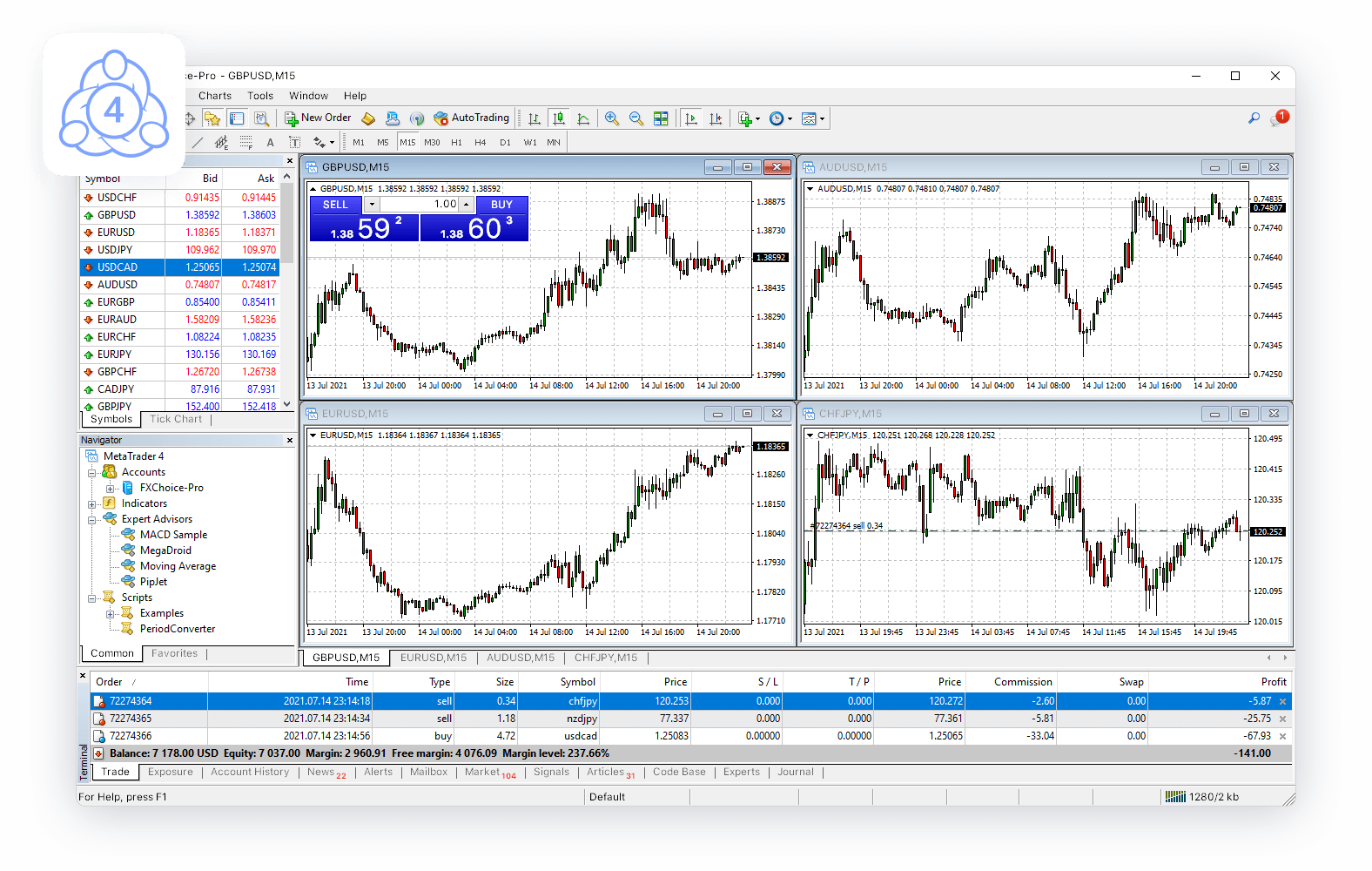

Metatrader 4 for windows stands as a cornerstone in the world of online trading platforms, particularly for Forex trading. Designed by MetaQuotes Software, MT4 offers a robust suite of features that cater to both novice and experienced traders alike. Here’s a comprehensive overview of what MT4 for Windows entails and the best plugins and add-ons available:

Overview of MetaTrader 4 for Windows:

MetaTrader 4 provides traders with a user-friendly interface that allows for seamless trading across various financial markets. Key features include real-time quotes, customizable charts, technical analysis tools, and automated trading through Expert Advisors (EAs). The platform supports multiple order types, including market orders, pending orders, and stop orders, making it versatile for different trading strategies.

Best Plugins and Add-Ons for MetaTrader 4:

MetaTrader Supreme Edition by Admiral Markets: This plugin offers a comprehensive suite of tools including additional indicators, advanced order types, and enhanced trading features. It also includes a mini terminal for quick order management and sentiment indicators to gauge market sentiment.

Autochartist: Ideal for traders who rely on technical analysis, Autochartist scans the market and identifies potential trading opportunities based on chart patterns and Fibonacci levels. It provides automated alerts and market reports directly within the MT4 platform.

Trade Terminal by FX Blue: This add-on enhances trade management capabilities by allowing traders to monitor multiple trades simultaneously. It offers features such as one-click trading, trade analysis tools, and custom trade closing strategies.

Conclusion:

MetaTrader 4 for Windows remains a preferred choice among traders due to its reliability, extensive features, and customizable options. By incorporating the best plugins and add-ons, traders can further enhance their trading experience and efficiency.

Metatrader 4: Understanding Market Liquidity

Navigating the intense seas of financial trading can be likened to competing in an Olympic sport. In both, the margin between a gold medal and a total washout can be razor-thin. What separates market champions from the rest isn’t just strategy or skill—it’s their emotional intelligence.

Metatrader 4 has cemented its place as more than a trading platform; it’s an ecosystem where traders learn to harness their psychology and emotional control to execute trades with precision. Here’s how to cultivate the mental fortitude that’s indispensable to trading success.

Understanding the Role of Trading Psychology

The backdrop to trading is as diverse as the markets themselves. Psychologically, traders wrestle with fear, greed, hope, and regret—otherwise known as the quartet of market emotions. Fear manifests as hesitation and second-guessing, while greed often leads to overconfidence and taking excessive risks. Hope keeps losing positions open for too long, and regret leads to chasing trades and deviating from a strategy.

Awareness of these emotions is the first step. Metatrader 4 offers tools to track, analyze, and improve trading behavior. The platform’s detailed trade history and advanced analytics can help investors spot patterns in their responses to the market, allowing for a more consistent and resilient approach. It’s not just about the profits, but the process and the self-discovery within it.

Developing Emotional Control

Financial markets are a paradigm where the only constant is change, and adapting to market movements while mitigating emotional interference is critical. Metatrader 4 fosters disciplined trading through several components. It allows for creating and backtesting strategies, which can reinforce the trader’s confidence in their system. Stop-loss and take-profit orders ensure that every trade has a planned exit strategy, which is vital in managing risk and removing the element of second-guessing.

One of the most potent tools for enhancing emotional control is the keep track of the real-time market sentiment through the platform’s top-tier integration of tools. By becoming adept at reading and responding to this sentiment, traders can maintain composure and objectivity, crucial for executing according to plan in the heat of market volatility. With diligence and commitment, traders can master their emotions and ensure they serve as allies rather than adversaries in the quest for consistent profitability.

Mastering MetaTrader 4 on Android: Top Tips for Efficient Trading

In today’s fast-paced financial markets, having access to your trading platform on-the-go is indispensable. metatrader 4 android empowers traders to stay connected and execute trades anytime, anywhere. To make the most out of this powerful tool, here are essential tips to enhance your trading experience:

1. Customizing Your Interface

Personalize your MT4 interface to suit your preferences. Adjust chart settings, colors, and layout for a comfortable and efficient trading environment. Experiment with different chart types, timeframes, and indicators to create a workspace that aligns with your trading style.

2. Utilizing Analytical Tools

MT4 on Android offers a range of analytical tools. Mastering these tools enhances decision-making. Experiment with various technical indicators, trend lines, and Fibonacci retracements to analyze market trends effectively. Utilize these tools to spot potential entry and exit points accurately.

3. Setting Alerts and Notifications

Take advantage of MT4’s alert and notification features. Set price alerts for specific currency pairs or commodities to stay informed about market movements. Configure notifications to receive updates on executed trades, margin levels, or pending orders. This proactive approach keeps you updated without constantly monitoring the app.

4. Managing Trades Effectively

Executing trades efficiently is crucial. Utilize MT4’s one-click trading feature for swift order placement. Implement stop-loss and take-profit orders to manage risks and secure profits. Additionally, use trailing stops to automatically adjust stop-loss levels as the market moves in your favor.

5. Practicing on Demo Accounts

Before diving into live trading, familiarize yourself with MT4’s functionalities using demo accounts. These accounts simulate real-market conditions, allowing you to practice strategies and refine your skills without risking actual funds.

6. Secure Login Practices

Prioritize security by using secure login methods. Enable two-factor authentication (2FA) to add an extra layer of protection to your account. Avoid logging in to MT4 on public Wi-Fi networks and regularly update your app to benefit from the latest security features.

7. Regularly Monitoring Market News

Stay informed about market news and events that might impact your trades. Use the economic calendar within MT4 to track significant announcements such as interest rate decisions, GDP reports, or geopolitical events. Being aware of these events helps in making informed trading decisions.

8. Managing Resources Wisely

Optimize your device’s resources for smooth MT4 performance. Close unnecessary background apps, clear cache regularly, and ensure your Android device has ample storage space. A well-maintained device ensures a seamless trading experience.

9. Exploring Additional Features

Explore beyond the basic functionalities of MT4. Familiarize yourself with additional features like copy trading, where you can replicate trades of successful traders, or automated trading using Expert Advisors (EAs) to execute strategies automatically.

10. Continuous Learning and Adaptation

Finally, the key to success in trading with MT4 is continuous learning and adaptation. Stay updated with market trends, try new strategies, and adapt to changing market conditions to stay ahead in the trading game.

Mastering MetaTrader 4 on Android involves a blend of technical expertise, strategic planning, and adaptability. Implementing these tips can significantly enhance your trading experience, allowing for informed decisions and better outcomes in the dynamic world of financial markets.